How to choose a classic car without losing money (i)

Investment or passion?

Classic cars can be a source of personal satisfaction and, at the same time, an interesting investment. However, the balance between passion and profitability is not always easy to achieve. In this article, we explore how to choose a classic car that not only thrills you to drive, but also maintains or increases in value over time. In this article I provide you with some data that you may find useful, but in a second part I will provide you with more precise price evolution tables.

1. Define the objective: Passion or investment?

Before buying a classic car, it is essential to ask yourself: do I want a car to enjoy it or for it to appreciate in value over time? Both approaches can coexist, but the purchase strategy changes depending on the objective.

- If you are looking for passion: Prioritize design, history and driving experience. Profitability takes a back seat.

- If you are looking for investment: You should study the demand, the scarcity of the model and the market trend. Some classics have shown steady appreciation, while others have lost value.

2. Choose between a "popular classic" or an "exclusive classic".

Not all classic cars have the same appreciation potential. There are two main investment categories in the market:

- Popular classic: More affordable models, generally manufactured in large volumes, such as the MGB, Alfa Romeo Spider, VW Beetle or iconic SEAT or Renault models manufactured between the 60s and 70s of the last century. They are accessible cars, with easy-to-find spare parts and relatively inexpensive maintenance. However, their revaluation is uncertain, as the abundance of units limits their exclusivity.

- Exclusive Classic: Rare models, produced in limited quantities or with a high historical value, such as the Ferrari 250 GTO, Jaguar E-Type Series 1 or Mercedes 300SL Gullwing. These cars tend to maintain or increase in value due to scarcity and high demand, but their entry price is high and generally out of reach for most enthusiasts.

The challenge lies in finding a balance. There are mid-high range models, such as the classic Porsche 911 or the Lancia Delta Integrale, which combine a price that is still reasonably affordable (in terms of investment, although a significant outlay is required) with a constant revaluation. In a more moderate but equally interesting line, you have the English roadsters, very attractive, and with a more affordable price than their two relatives -German and Italian-, previously mentioned.

3. Condition, authenticity and restoration costs

The state of preservation of a classic car directly influences its value. Factors to review (advisable):

- Originality: A car with original parts and without extreme modifications has a higher value.

- Maintenance history: A detailed record of repairs and restorations is key for potential buyers.

- Absence of rust and structural damage: The restoration of a car with serious problems may exceed its market value.

- Attention to restoration needs: A crucial aspect to consider is that certain restoration works, such as upholstery, bodywork or paint, have similar costs in both an affordable and an exclusive model. However, the percentage of the restoration cost versus the listed value varies greatly. On a low-priced classic car, a complete restoration may exceed its market value, while on an exclusive model it may represent only a fraction of its final price and significantly increase its value.

Examples of typical restoration costs:

-

- Complete upholstery with professional finish: Between 2,000 and 3,000 €.

- Quality paint and plate work: Between 2,000 and 3,000 €. Be wary of the “breaker” offers of very cheap prices for painting a whole car. In this type of work is very applicable the saying that “to buy cheap is to buy twice”.

- Necessary spare parts and adjustments (even if the car is in good condition): Count an imponderable of at least €1,000 in parts such as gaskets, covers, pilot frames in poor condition, dashboard controls that do not work, brake adjustments, among others.

- Instrumentation and clockwork: If the car is of a certain age and has mechanical instrumentation, it can be expensive to repair or replace. For example, a tachometer for an MG TD can cost around 500 €, while a mechanical oil pressure gauge for an English car can range between 250 and 300 €. If these items are found to be faulty, it is advisable to negotiate with the seller to either a) replace them before the sale or b) adjust the price according to the replacement cost.

- Repair of rims: If they are bent, bent, rusted, or damaged in general, consider between 100 and 200 euros per rim to be repaired. Special attention to the spoke rims and more if they are chromed. The price can become more expensive. Attention also to the tires: In very old cars (from the year 60 back, the unusual measures -for the current standards- will make the cost per wheel higher as well. Count between 150 and 200 euros more per wheel in case of tire replacement.

4. Maintenance and insurance costs

A key aspect to evaluate before buying a classic car is the level of one’s own mechanical knowledge and the availability of facilities to carry out repairs oneself. If this is not possible, it is important to consider that labor costs can be high, since in these cars the time needed to repair a breakdown can be uncertain. In many cases, certain interventions require more hours of work than expected, which can significantly increase the bill if an outside professional must be called in.

In addition, it is important to be willing to buy spare parts outside the country. In the European Union, this is not a problem, as all suppliers within the EU sell to any other member country without restrictions. However, if buying from the UK, be aware of the additional import fees that apply since Brexit. Generally, when importing parts from the UK to the EU, these should be considered:

- Import tariffs: For most spare parts, the standard tariff is 4%, although it may vary according to product classification.

- VAT: VAT must be paid in the country of destination, which may be an additional 19% to 25%.

- Customs handling fees: Shipping and courier companies may apply additional fees for customs clearance, generally between €20 and €50.

Before making a purchase, it is advisable to make an estimate of these additional costs – if you think you may have them – to avoid surprises.

In any case, far from being a barrier, buying abroad is often the best solution to find spare parts that are difficult to obtain in the local market.

Therefore, to summarize:

A classic car will generate expenses in maintenance, parts and insurance. Before you buy, consider:

- Parts availability: Some brands have readily available parts, while others, as I mentioned to you, require importation. It is advisable to check the costs of major spare parts at different suppliers. different suppliersas they may vary according to the brand. For example, for British cars such as MG and Triumph, you can consult catalogs from suppliers such as MOSS Europe o Limora. For classic Renaults, there are French specialists such as Arnaud Ventoux Pièces. In addition, some brands such as BMW, Mercedes and Volkswagen have classic maintenance programs that offer original spare parts, although often at a high cost. Evaluating the availability and prices of spare parts before purchase is key to avoid surprises.

- Maintenance cost: Cars with complex mechanics can be costly to maintain.

- Type of insurance: There are specific insurances for classics with coverage adapted to their occasional use. It is not usually a big outlay, and by the way, I advise you to insure fully comprehensive. It is possible to do so. See here.

5. The importance of convertibles in revaluation

Convertible cars tend to have a higher appreciation in the classic market. Their aesthetic appeal, unique driving experience and lower production compared to their closed versions make them more coveted. For example, a Volkswagen Karmann Ghia cabrio is often priced significantly higher than the coupe version, reflecting this market trend.

Currently, in the classic market, a Volkswagen Karmann Ghia coupe from the 60s and 70s can be found in the range of 25,000 – 35,000 €, depending on condition and originality. However, the convertible version of the same model usually exceeds 40,000 €, and in some well-restored cases, reaches 50,000 € or more. This difference is due to the lower production of the cabrio versions and their greater appeal among collectors and enthusiasts.

6. Models with the highest revaluation in recent years

Classics with an average price of more than 45,000 euros (*)

|

Model |

Year of manufacture |

Average price |

|

Ferrari 250 GTO |

1962-1964 |

50.000.000 € |

|

Mercedes-Benz W196 |

1954-1955 |

22.700.000 € |

|

Duesenberg SJ |

1932-1937 |

4.500.000 € |

|

Ferrari 212 Export |

1951-1952 |

3.000.000 € |

|

Ferrari F40 |

1987-1992 |

700.000 € |

|

Chevrolet Camaro IROC-Z |

1989 |

100.000 € |

|

Volvo 850 |

1990 |

50.000 € |

(*) Average market prices as of March 2025

Classics with an average price between 12,000 and 45,000 euros (*)

|

Model |

Year of manufacture |

Average price |

|

Porsche Boxster (986) |

1997-2004 |

15.000 € |

|

Mercedes-Benz SL 500 (R129) |

1989-2001 |

18.000 € |

|

BMW M5 (E34) |

1988-1996 |

25.000 € |

|

Lancia Delta HF Integrale |

1988-1994 |

40.000 € |

|

Jaguar XJ6-L Series II |

1978 |

12.000 € |

|

Volkswagen Karmann Ghia Cabrio |

1960-1974 |

35.000 € |

|

Citroën DS 21 Pallas |

1967-1972 |

30.000 € |

|

Alfa Romeo Spider (Duetto) |

1966-1994 |

22.000 € |

|

Ford Mustang (1st generation) |

1964-1973 |

28.000 € |

|

Chevrolet Corvette C3 |

1968-1982 |

32.000 € |

|

Triumph TR6 |

1969-1976 |

30.000 € |

|

Triumph TR3 |

1955-1962 |

32.000 € |

|

MG A |

1955-1962 |

35.000 € |

|

Austin-Healey 3000 |

1959-1967 |

42.000 € |

(*) Average market prices as of March 2025

Classics with an average price up to 12,000 Euros (*)

|

Model |

Year of manufacture |

Average price |

|

Volkswagen Beetle |

1960-1970 |

8.500 € |

|

Citroën 2CV |

1970-1980 |

7.800 € |

|

Fiat 500 |

1960-1975 |

9.200 € |

|

MG Midget |

1961-1979 |

9.000 € |

|

Renault 4 |

1961-1992 |

6.500 € |

|

Triumph Spitfire MkIV/1500 |

1970-1980 |

9.500 € |

|

MG B Rubber Bumper |

1974-1980 |

9.800 € |

|

Volkswagen Golf Mk1 |

1974-1983 |

9.000 € |

|

SEAT 600 |

1957-1973 |

7.500 € |

|

SEAT 127 |

1972-1983 |

6.800 € |

|

SEAT 1430 |

1969-1976 |

8.200 € |

|

Renault 8 |

1962-1973 |

9.000 € |

|

Simca 1000 |

1961-1978 |

5.700 € |

|

Renault 5 GT Turbo |

1985-1991 |

11.500 € |

|

Fiat Panda 100HP |

2006-2010 |

2.800 £ |

(*) Average market prices as of March 2025

Here are some models that have shown a remarkable revaluation in recent years:

-

- Maserati MC12: This Italian supercar has seen a 53% increase in value from €2,047,480 in December 2023 to €3,131,440 in December 2024.

- Fiat Coupé: This 1990s model has seen its price double in a short time, from 4,000 to 7,000 euros in 2020.

- Porsche 911: The iconic German sports car has maintained an upward trend in valuation, establishing itself as a solid investment in the classic market.

- Alfa Romeo 147 GTA (2001-2005): This modern model with a 3.2-liter engine has been identified as a promising investment, with a current value of around £8,500 and upside potential.

- Austin-Healey 3000 (1959-1967): This British classic is recognized for its revaluation potential, with prices ranging from £45,400 to £87,500.

So, when considering the acquisition of a classic car as an investment, it is essential to evaluate factors such as originality, state of preservation and demand in today’s market. Models that combine history, attractive design and limited production usually offer greater opportunities for appreciation.

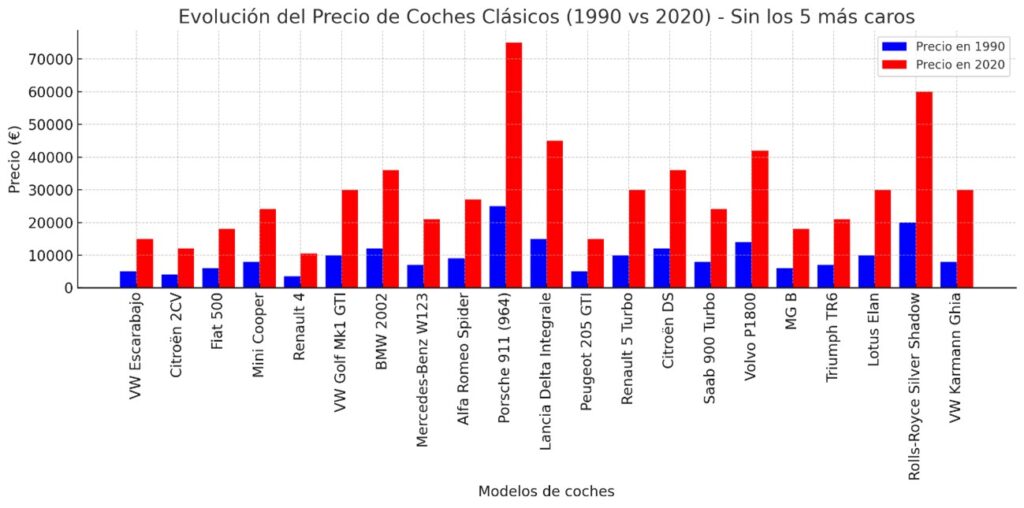

7. Data and tables : Classical models and their price evolution

Comparison 1990 Vs 2020

Here is a selection of 26 European classic cars manufactured between 1950 and 1990, with different price ranges and their evolution in the market:

|

Model |

Country of origin |

Years of manufacture |

Price in 1990 |

Price in 2020 |

Increase (%) |

|

Volkswagen Beetle |

Germany |

1938 – 2003 |

€5,000 |

€15,000 |

200% |

|

Citroën 2CV |

France |

1948 – 1990 |

€4,000 |

€12,000 |

200% |

|

Fiat 500 |

Italy |

1957 – 1975 |

€6,000 |

€18,000 |

200% |

|

Mini Cooper |

United Kingdom |

1959 – 2000 |

€8,000 |

€24,000 |

200% |

|

Renault 4 |

France |

1961 – 1992 |

€3,500 |

€10,500 |

200% |

|

Volkswagen Golf Mk1 GTI |

Germany |

1976 – 1983 |

€10,000 |

€30,000 |

200% |

|

BMW 2002 |

Germany |

1968 – 1976 |

€12,000 |

€36,000 |

200% |

|

Mercedes-Benz W123 |

Germany |

1976 – 1985 |

€7,000 |

€21,000 |

200% |

|

Alfa Romeo Spider |

Italy |

1966 – 1993 |

€9,000 |

€27,000 |

200% |

|

Porsche 911 (964) |

Germany |

1989 – 1994 |

€25,000 |

€75,000 |

200% |

|

Lancia Delta Integrale |

Italy |

1979 – 1994 |

€15,000 |

€45,000 |

200% |

|

Jaguar E-Type |

United Kingdom |

1961 – 1975 |

€40,000 |

€120,000 |

200% |

|

Ferrari 308 GTB |

Italy |

1975 – 1985 |

€35,000 |

€105,000 |

200% |

|

Aston Martin V8 Vantage |

United Kingdom |

1977 – 1989 |

€50,000 |

€150,000 |

200% |

|

Lamborghini Countach |

Italy |

1974 – 1990 |

€80,000 |

€240,000 |

200% |

|

Peugeot 205 GTI |

France |

1984 – 1994 |

€5,000 |

€15,000 |

200% |

|

Renault 5 Turbo |

France |

1980 – 1986 |

€10,000 |

€30,000 |

200% |

|

Citroën DS |

France |

1955 – 1975 |

€12,000 |

€36,000 |

200% |

|

Saab 900 Turbo |

Sweden |

1978 – 1998 |

€8,000 |

€24,000 |

200% |

|

Volvo P1800 |

Sweden |

1961 – 1973 |

€14,000 |

€42,000 |

200% |

|

MG B |

United Kingdom |

1962 – 1980 |

€6,000 |

€18,000 |

200% |

|

Triumph TR6 |

United Kingdom |

1968 – 1976 |

€7,000 |

€21,000 |

200% |

|

Lotus Elan |

United Kingdom |

1962 – 1973 |

€10,000 |

€30,000 |

200% |

|

Bentley S2 |

United Kingdom |

1959 – 1962 |

€25,000 |

€75,000 |

200% |

|

Rolls-Royce Silver Shadow |

United Kingdom |

1965 – 1980 |

€20,000 |

€60,000 |

200% |

|

Volkswagen Karmann Ghia |

Germany |

1955 – 1974 |

€8,000 |

€30,000 |

275% |

Data sources

The price estimates and value developments for classic cars in this article have been obtained from a variety of sources, including:

- Business Insider: Analysis of the evolution of classic car prices.

- Autopista.es: Maintenance and overhaul costs for classic cars.

- Alfonso Figares: General maintenance costs of classic vehicles.

- Engine-4: Impact of use and age on maintenance costs.

- Forums and chats: Experiences of classic car owners.

For greater accuracy, it is recommended to consult updated sources such as specialized auction houses (RM Sotheby’s, Bonhams) or price guides such as Hagerty and Classic Trader.

The dark side of classic car appreciation: between appreciation and speculation

The rise in prices of classic cars has had a positive effect on their appreciation, as many models that were once viewed simply as old cars are now recognized for their historical and cultural value. Moreover, in many cases, this increase has made restorations economically viable, allowing examples that would otherwise have ended up on the scrap heap to be rescued and restored to their original splendor.

However, this phenomenon has also brought with it a downside: speculation and the transformation of the market into a space sometimes dominated by investment rather than passion.

Financial interest has artificially inflated prices, driving these cars away from true enthusiasts, who value them for their history, mechanics and enjoyment on the road, and placing them in the hands of collectors and investors who see them only as assets with appreciation potential. As a result, many classics are left in unused storage, waiting for the opportunity to be sold at a profit, instead of being enjoyed and kept in circulation. This speculative bubble not only makes it difficult for new enthusiasts to gain access to these vehicles, but also alters the dynamics of collecting and restoration: they are no longer restored for the love of the car, but for the profitability of the operation.

This paradigm shift is detrimental to the authentic hobby and the preservation of the automotive heritage, as access to classics is restricted to those who can afford to pay increasingly higher prices, to the detriment of those who would really care for them and maintain them in the spirit in which they were conceived. Thus, the market ceases to be a space of enthusiasm and automotive culture to become a financial game, where speculation takes precedence over passion and the legacy of these vehicles is at risk of becoming a mere luxury commodity.

Conclusion

- Choosing a classic car can be both an emotional and financial decision. Evaluating the balance between enjoyment and profitability is key.

- While some models may offer steady appreciation in value, the passion for driving and the history behind each vehicle remain determining factors for many enthusiasts. The key is to know the market, analyze maintenance and restoration costs, and be realistic about additional expenses that may arise.

- In addition, the availability of spare parts and ease of maintenance are essential to prevent the investment from becoming a disproportionate expense. Those with mechanical expertise and the space to do the work themselves can significantly reduce costs and improve the value of their vehicle.

- Finally, being open to international purchasing can expand opportunities to find the ideal model, especially in markets with greater supply. Leveraging specialized suppliers and understanding import duties and taxes allows you to make informed decisions and avoid unexpected costs.

- In short, a classic car is not only an economic investment, but also an investment in experience, history and emotion. With good planning and the right choice, you can enjoy a classic without losing money and, in the best case, see its value increase over time.

- Finally, buying a classic car on speculation alone can backfire on the investor, contributing to an inflated and unstable market. Artificial rises limit access to true enthusiasts and can lead to steep drops in value. The best investment in a classic is not only financial, but also emotional: it should be bought to be enjoyed, not just to wait for appreciation.